Vision for 2030 and Growth Strategy

2030 Vision

Toward 2030

Establish our pivotal growth drivers in overseas markets and new food domains

Presentation for Growth Strategy(Feb. 21, 2023)

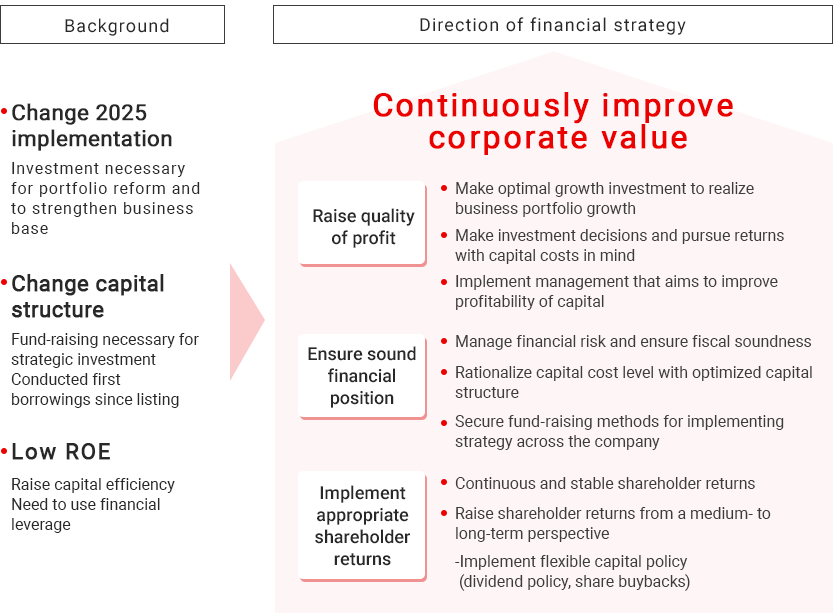

Review of direction of

financial strategy

Improve corporate value by promoting optimal investment for growth while ensuring financial position

- 1Aggressive investment to transform the portfolio and strengthen the business base

- 2Financing and capital structure to meet high investment demand

- 3Active asset efficiency and the use of financial leverage